56th GST Council Meeting Highlights – GST Rate Changes & Key Decisions (September 2025)

56th GST Council Meeting Highlights – GST Rate Changes & Key Decisions (September 2025)

The 56th GST Council Meeting was held on 3rd September 2025 in New Delhi under the chairpersonship of Union Finance Minister Smt. Nirmala Sitharaman. The Council announced important changes in GST rates, relief measures for the common man, and major reforms to simplify compliance for businesses.

If you’re a taxpayer, business owner, or professional, here are the key updates you must know.

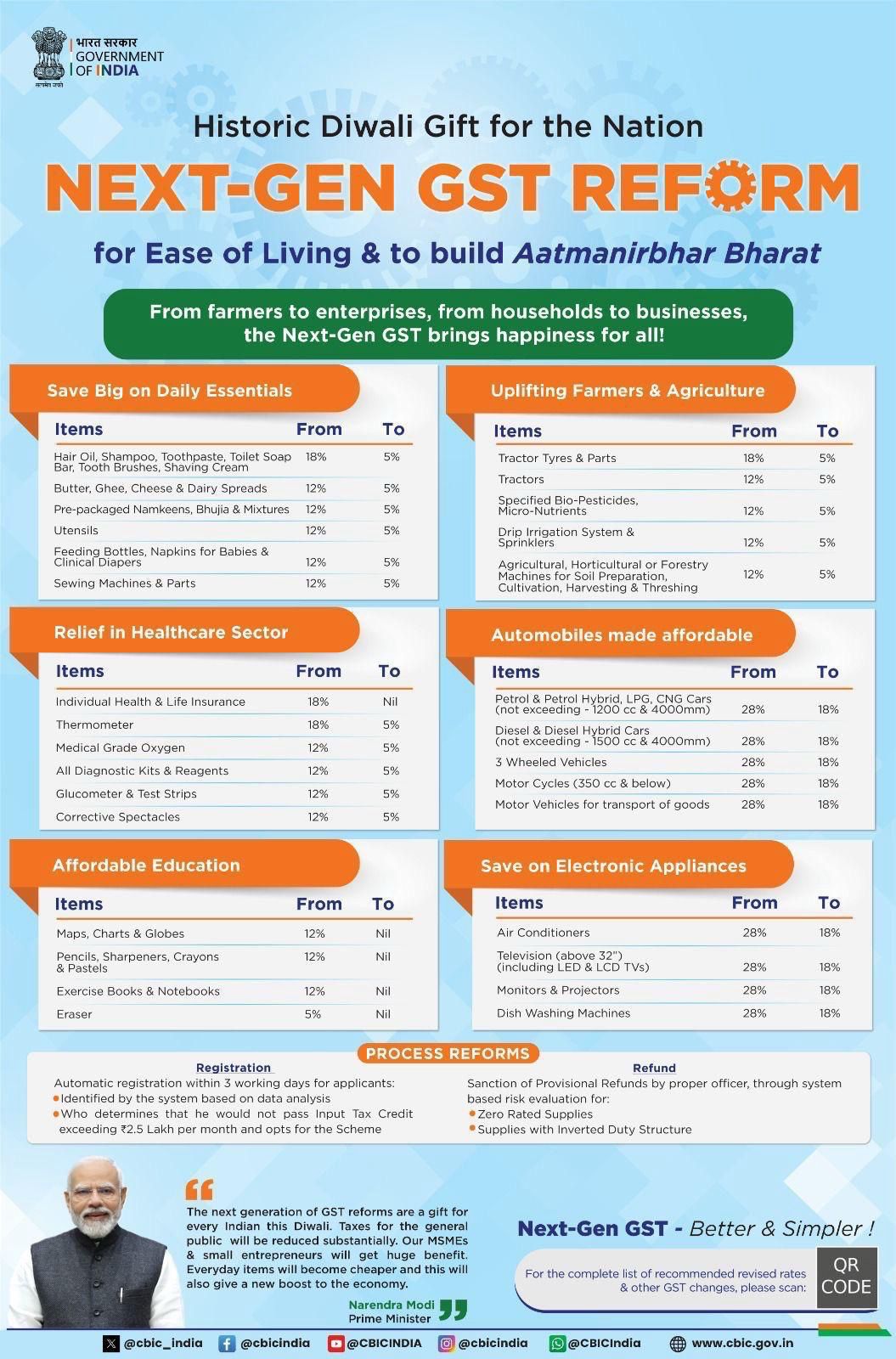

🔑 GST Rate Changes Announced in 56th GST Council Meeting

1. Changes in GST on Goods

-

Pan Masala, Gutkha, Cigarettes, Tobacco Products → GST will now be levied on the Retail Sale Price (RSP) instead of the transaction value.

-

Luxury Car Exemption → An armoured sedan imported for the President of India will get exemption from IGST & Compensation Cess.

2. Changes in GST on Services

-

Restaurant Services → A clarification was issued: standalone restaurants cannot declare themselves as “specified premises” to pay 18% GST with ITC.

-

Lottery Tickets → Valuation rules have been amended to align with new tax rates.

📅 Effective Date of Implementation

The GST Council decided on a phased rollout of new rates:

-

22nd September 2025 → All new GST rates on services and most goods will apply.

-

Tobacco & related products (Pan Masala, Gutkha, Cigarettes, Zarda, Bidi, etc.) → Will continue at existing rates until the Compensation Cess Loan obligations are fully repaid.

-

Refunds → A risk-based system for 90% provisional refunds on inverted duty structure will be implemented, similar to zero-rated supplies.

⚖️ GST Appellate Tribunal (GSTAT) to Start Soon

One of the biggest reforms from the 56th Council meeting is the operationalisation of the Goods & Services Tax Appellate Tribunal (GSTAT):

-

Appeals will be accepted by end of September 2025.

-

Hearings will start before December 2025.

-

Backlog appeal filing deadline → 30th June 2026.

-

The Principal Bench of GSTAT will also act as the National Appellate Authority for Advance Ruling (NAAAR).

This will bring consistency in advance rulings, reduce litigation delays, and enhance taxpayer confidence.

⚙️ GST Process Reforms & Trade Facilitation

The Council has also proposed several process reforms to ease compliance (detailed notifications will be issued soon).

Key focus areas:

-

Simplified procedures for trade and exports.

-

Improved refund mechanisms.

-

Clearer guidelines for rate applicability.

📌 FAQs on 56th GST Council Meeting

Q1: When will the new GST rates be applicable?

👉 From 22nd September 2025 (except tobacco & related products).

Q2: What is the major change for restaurant services?

👉 Standalone restaurants cannot misuse the “specified premises” definition to pay 18% GST with ITC.

Q3: When will GSTAT start functioning?

👉 Appeals can be filed from September 2025, and hearings will begin before December 2025.

Q4: What happens to GST on Pan Masala & Cigarettes?

👉 They will continue under existing rates until the Compensation Cess Loan account is settled.

📢 Final Word – Why This GST Council Meeting Matters

The 56th GST Council Meeting (Sept 2025) is a milestone reform, balancing:

-

Relief to the common man & middle class,

-

Fair taxation on tobacco and luxury goods,

-

A robust dispute resolution system via GSTAT, and

-

Simplified compliance for businesses.

Taxpayers and professionals should update their ERP/accounting systems for rate changes from 22nd September 2025, and keep track of GSTAT updates for filing appeals within the new timelines.